Borrowing money is sometimes necessary for handling major expenses such as education, home repairs, or medical bills. However, the cost of borrowing depends largely on the interest rate attached to the loan. Choosing a low interest rate loan can make a significant difference in how much you repay over time.

Today, many lenders provide Affordable Loans Offers designed to help individuals access funds without paying very high interest charges. With the help of a low interest personal loan app, borrowers can compare loan options, review repayment terms, and apply online without complicated procedures.

A lower interest rate reduces the total repayment amount, making it easier to manage finances. Understanding how these loans work can help borrowers make better financial decisions and avoid unnecessary expenses.

Understanding a Low Interest Rate Loan

A low interest rate loan is a borrowing option where the lender charges a smaller percentage of interest on the borrowed amount. This means the borrower pays less money over the repayment period compared to loans with higher interest rates.

Interest rates vary depending on several factors such as the borrower’s credit history, income stability, loan amount, and repayment period. Lenders may also adjust interest rates based on market conditions and internal policies.

When borrowers select a loan with a lower interest rate, the monthly payments become more manageable. This can help individuals maintain a stable budget and avoid financial pressure during repayment.

Why Interest Rates Matter When Taking a Loan

Interest rates directly affect the overall cost of borrowing. Even a small difference in the rate can lead to noticeable changes in the total amount repaid.

Lower Monthly Payments

A lower rate reduces the interest portion included in each monthly installment. As a result, borrowers can manage payments without affecting other financial responsibilities.

Reduced Total Loan Cost

Over the full loan tenure, a smaller interest rate means the borrower pays less money overall.

Easier Financial Planning

When repayments remain affordable, individuals can plan their finances better without adjusting their daily expenses frequently.

Features of Affordable Loans Offers

Many lenders promote Affordable Loans Offers to attract borrowers looking for manageable repayment options. These offers often include features that make borrowing easier and more flexible.

Competitive Interest Rates

Affordable loan offers usually come with interest rates lower than the average market rate, helping borrowers reduce costs.

Flexible Repayment Terms

Borrowers can often choose repayment periods that suit their financial situation. Longer repayment periods reduce monthly payments, while shorter tenures reduce total interest paid.

Simple Application Process

Many lenders provide online application systems that reduce paperwork and speed up the loan process.

Transparent Terms

Reliable loan providers explain the interest rate, repayment schedule, and fees clearly before approving the loan.

How a Low Interest Personal Loan App Helps Borrowers

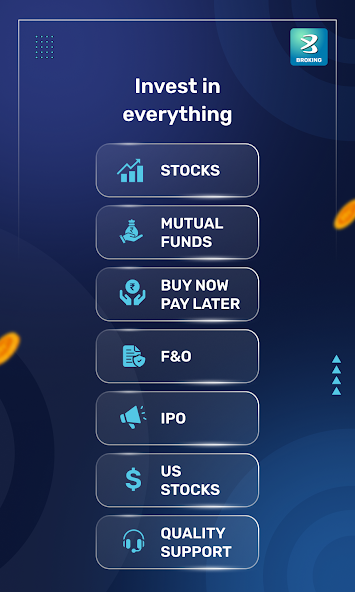

Technology has changed how people apply for loans. A low interest personal loan app allows borrowers to access loan options directly from their mobile devices.

Quick Comparison of Loan OptionsBorrowers can compare interest rates, loan amounts, and repayment terms from different lenders before making a decision.

Online Application Convenience

Instead of visiting physical branches, users can complete the loan application through their smartphones.

Instant Loan Status Updates

Many apps provide real-time updates about application approval, document verification, and disbursement progress.

Easy Document Submission

Most loan apps allow users to upload identification and income documents digitally, reducing the need for printed paperwork.

Factors That Influence Loan Interest Rates

Several factors determine whether a borrower qualifies for a lower interest rate.

Credit Score

A strong credit history shows that the borrower has repaid previous loans on time. This increases the chances of receiving a lower interest rate.

Income Stability

Lenders often prefer borrowers who have consistent income, as it indicates the ability to repay the loan regularly.

Loan Amount

The amount borrowed may affect the interest rate. Some lenders offer better rates for certain loan ranges.

Repayment Tenure

Shorter loan durations may result in lower interest costs, although monthly payments might be higher.

Tips for Getting a Low Interest Rate Loan

Borrowers can improve their chances of securing better loan terms by following a few practical steps.

Maintain a Good Credit Record

Paying bills and existing loans on time helps maintain a healthy credit profile.

Compare Multiple Lenders

Looking at different loan providers helps borrowers identify the best interest rates available.

Borrow Only What Is Necessary

Taking a smaller loan amount may reduce the interest burden and make repayment easier.

Check Loan Conditions Carefully

Understanding all terms, including fees and repayment schedules, prevents unexpected costs later.

Common Uses of Low Interest Rate Loans

Low interest rate loans are often used for several types of financial needs.

- Education expenses

- Home improvements

- Medical treatments

- Debt consolidation

- Personal emergencies

Because these loans cost less over time, they can help borrowers manage important expenses without paying excessive interest.

Mistakes to Avoid When Applying for a Loan

While looking for a low interest loan, borrowers should avoid certain common mistakes.

Ignoring Additional Charges

Some loans may include processing fees or service charges that increase the total borrowing cost.

Choosing Long Repayment Periods Without Review

While longer repayment periods reduce monthly payments, they may increase the overall interest paid.

Applying Without Comparing Options

Selecting the first loan offer without checking alternatives may lead to higher costs.

Conclusion

Choosing a low interest rate loan can help borrowers manage expenses while keeping repayment costs under control. By selecting the right loan terms and comparing different lenders, individuals can reduce the financial burden of borrowing.

Today, many lenders promote Affordable Loans Offers that help people access funds without paying excessive interest. With the availability of a low interest personal loan app, borrowers can explore loan options, compare rates, and complete the application process easily.

Before taking a loan, it is important to review the interest rate, repayment schedule, and additional charges. Careful planning ensures that the loan remains affordable and supports financial stability rather than creating additional pressure.